|

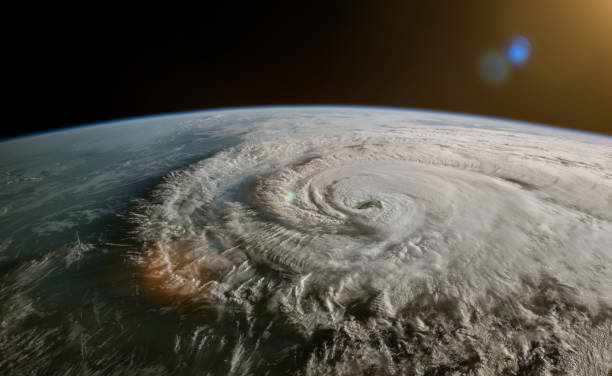

If you live in the Southeast, you know that hurricane season can be a very stressful time of year. There is always the potential for a major storm to hit, and that can mean costly damage to your home or business. That's why it's so important to have hurricane insurance in place before the season begins. Hurricane insurance will help to cover the cost of repairs to your property if it is damaged by a storm.

It can also help to cover the cost of temporary housing if your home is uninhabitable after a storm. And perhaps most importantly, hurricane insurance can give you peace of mind knowing that you are prepared for whatever Mother Nature might throw your way. Types of Hurricane Insurance Coverage There are two types of hurricane insurance coverage: windstorm and named storm. Windstorm coverage will protect your property from damage caused by high winds, regardless of whether or not there is a named storm in the area. Named storm coverage, on the other hand, will only activate if there is a tropical cyclone with sustained winds of at least 74 MPH in the forecast. Most policies will offer both types of coverage, but it's important to check with your insurer to be sure. You may also want to consider purchasing additional flood coverage, as this is not typically included in hurricane insurance policies. Flooding can often occur as a result of storms, and it can cause extensive damage to your property. Deductibles and Limits Another important thing to keep in mind when shopping for hurricane insurance is that policies typically have high deductibles and limits. This means that you will be responsible for paying a significant portion of any damages out-of-pocket. For example, let's say that your policy has a $5,000 deductible and you suffer $10,000 worth of damage to your home. In this case, your insurer would pay $5,000 and you would be responsible for paying $5,000 yourself. This highlights the importance of having adequate savings set aside to cover the cost of repairs in the event that your property is damaged by a storm. Otherwise, you could find yourself facing thousands of dollars in damages that you are unable to pay for. Hurricane season is here now! Many in Florida are finding out the importance of hurricane insurance recently due to Hurricane Ian. It is beyond the time to make sure that you have adequate insurance coverage in place. Don't wait until another large storm is bearing down on your area to start shopping for coverage - by then it will be too late. If you don't have it, talk to your insurer today about adding hurricane insurance to your policy, and be sure to ask about deductibles and limits so that you know what to expect if worst comes to worst. At Arrow Insurance, though we love to help those near our town of Loganville, GA, we are a licensed independent insurance agency in Alabama, Florida, Georgia, and South Carolina. We exist to shoot straight with you. We'll tell you the coverage you need and nothing else. Hopefully before the next storm.

1 Comment

|

Contact Us(770) 692-7500 Archives

June 2024

Categories

All

|

We are licensed in Alabama, Florida, Georgia, South Carolina

Navigation |

Connect With UsShare This Page |

Contact UsArrow Insurance Agency

3925 Harrison Rd Suite 200 Loganville, GA 30052 (770) 692-7500 Click Here to Email Us |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed